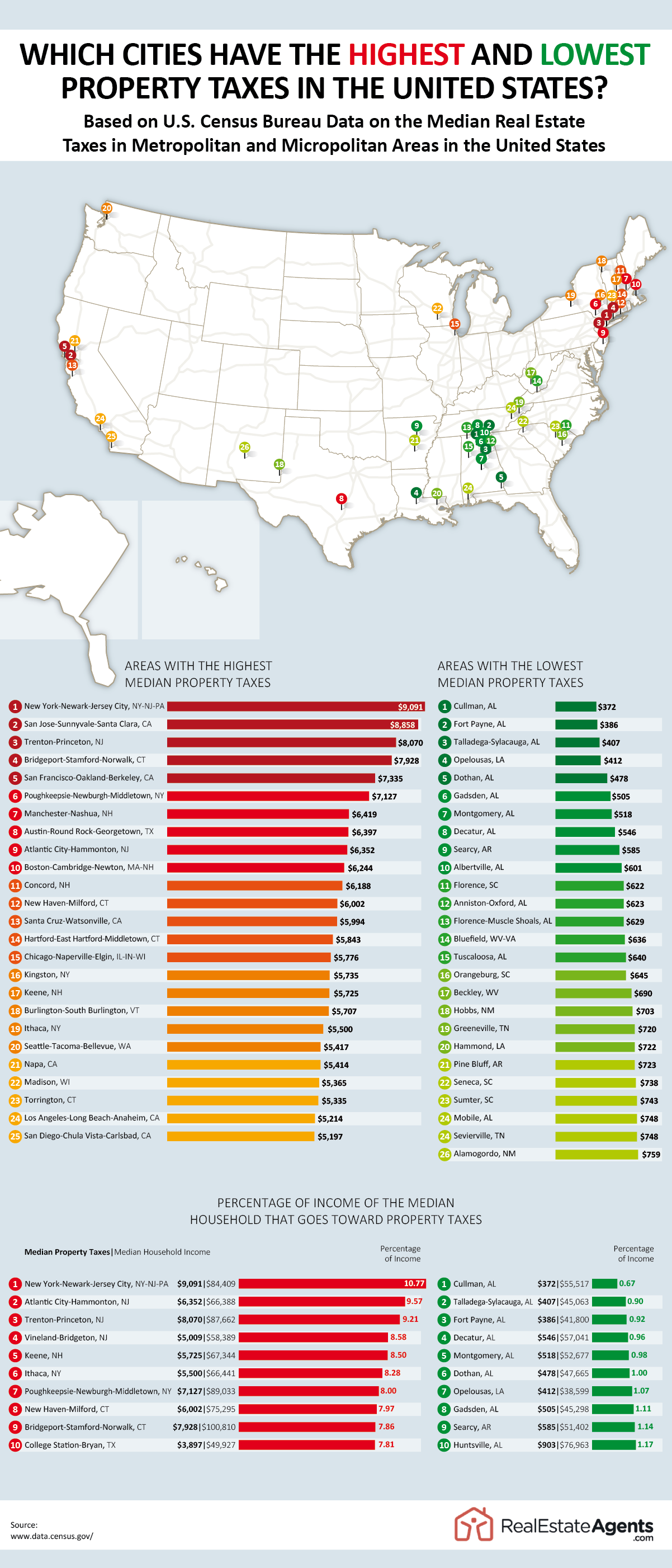

Owning a home can be great, but it does come with significant expenses. From home repairs and furniture to taxes, new homeowners can expect to shell out more money than when they were renting. Do you know which cities in the U.S. pay the most in property taxes?

Real estate website RealEstateAgents.com created a graphic that shows exactly where in the country homeowners are paying the most and least property taxes. Keep reading to see how property taxes vary around the U.S.!

New York City, which is known for high home prices and expensive cost of living, tops the list of cities with the highest property taxes. The median property taxes in the New York City metro area (which includes Newark and Jersey City, NJ) are $9,091.

The following are the top 10 cities where property taxes are most expensive:

- New York-Newark-Jersey City, NY-NJ-PA: $9,091

- San Jose-Sunnyvale-Santa Clara, CA: $8,858

- Trenton-Princeton, NJ: $8,070

- Bridgeport-Stamford-Norwalk, CT: $7,928

- San Francisco-Oakland-Berkeley, CA: $7,335

- Poughkeepsie-Newburgh-Middletown, NY: $7,127

- Manchester-Nashua, NH: $6,419

- Austin-Round Rock-Georgetown, TX: $6,397

- Atlantic City-Hammonton, NJ: $6,352

- Boston-Cambridge-Newton, MA-NH: $6,244

On the other end of the spectrum, these are the 10 cities where property taxes are least expenses:

- Cullman, AL: $372

- Fort Payne, AL: $386

- Talladega-Sylacauga, AL: $407

- Opelousas, LA: $412

- Dothan, AL: $478

- Gadsden, AL: $505

- Montgomery, AL: $518

- Decatur, AL: $546

- Searcy, AR: $585

- Albertville, AL: $601

Which city’s position on the list is most surprising?

Leave a Reply