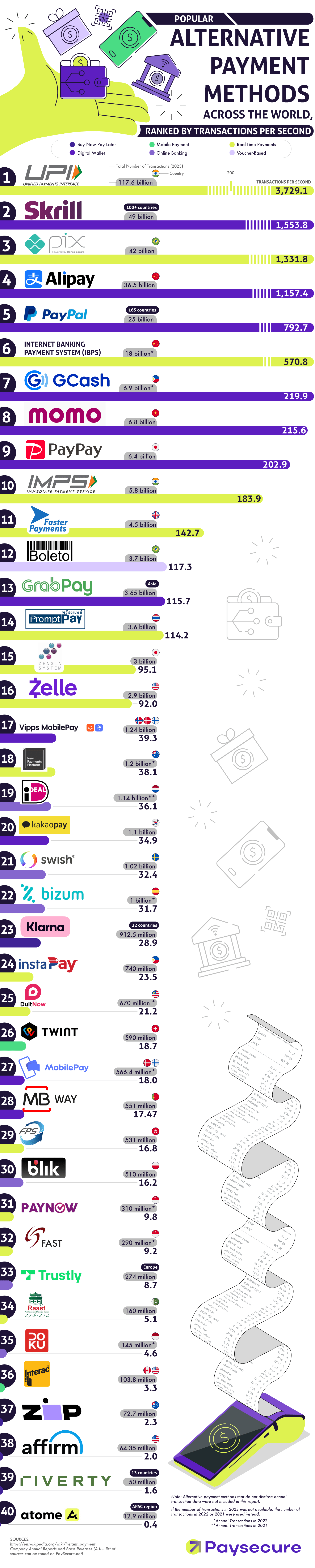

There are many advantages to leaving cash in the past. Cash-less transactions are often quicker, and shoppers won’t have to stop at an ATM with fees and security issues. Skipping cash when traveling is much safer too. It lessens the chance travelers will become a target of muggers and pickpockets. While many people use their debit or credit card instead of cash, there might be an even stronger option for going cash-less. Alternative payment methods are any transaction method that isn’t cash, credit, or debit card based. These methods are rising in popularity all around the world and this infographic from Paysecure really illustrates the power behind these methods.

As the infographic indicates, alternative payment methods often take these forms:

- Digital Wallet

- Buy Now Pay Later plans

- Mobile Payment

- Online Banking

- Real-Time Payments

- Voucher-Based Systems

The infographic ranks the most used methods worldwide, based on the number of transactions per second made in 2023. We also see the country of origin for each method, so this is a truly comprehensive look at banking methods with staying power.

Here are the top 10 alternative methods according to the infographic:

- United Payments Interface (UPI)

- Skrill

- Pix

- Alipay

- PayPal

- Internet Banking Payment System (IBPS)

- GCash

- Momo

- PayPay

- Immediate Payment Service (IMPS)

With the top method, UPI accruing 117.6 billion transactions in 2023 we can clearly see how powerful alternative payment methods. Look over the details on the infographic to see just how widespread these systems are.

Leave a Reply